|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

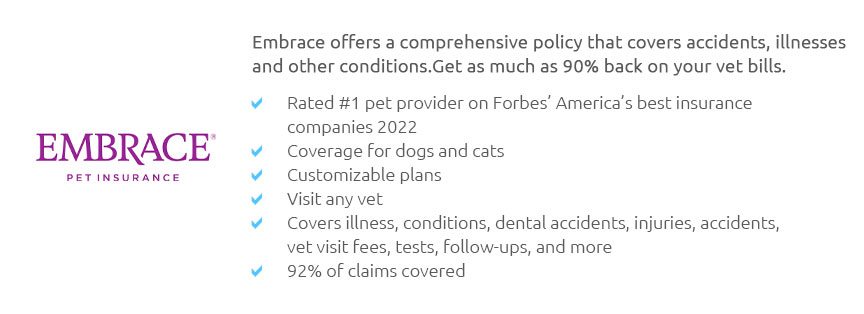

Discovering the Best Ways to Compare Pet Insurance OnlineIn today's fast-paced digital era, the task of ensuring our beloved furry companions receive the best possible care has evolved beyond mere visits to the local veterinarian; now, it encompasses the prudent selection of pet insurance policies, a process that can be both enlightening and daunting, especially when approached with the myriad of options available online. As a pet owner, one of the most significant decisions you might face is determining how to financially safeguard your pet against unforeseen medical expenses; this is where comparing pet insurance online becomes an invaluable tool, allowing you to sift through countless plans, benefits, and premiums to find the coverage that best suits your needs and budget. To begin this journey, it's crucial to recognize that the landscape of pet insurance is as diverse as the animals it aims to protect; thus, understanding the key features and variations among policies is paramount.

Online comparison tools and resources have made it easier than ever to analyze these variables across different providers, enabling pet owners to make informed decisions without the overwhelming pressure of traditional insurance shopping; many websites offer side-by-side comparisons, customer reviews, and expert ratings, all designed to streamline the selection process and highlight the pros and cons of each policy. Moreover, customer service and reputation should not be overlooked; the ease of filing claims and the responsiveness of the insurance company can greatly affect your experience and satisfaction, so it's wise to delve into testimonials and feedback from other pet owners who have walked the same path. In conclusion, while the abundance of information available online may seem overwhelming, approaching the task of comparing pet insurance with a strategic mindset can transform it into an empowering exercise; by carefully considering coverage options, financial commitments, and company reputations, you can confidently choose a policy that not only fits your budget but also ensures your pet receives the care they deserve, allowing you to enjoy peace of mind and focus on what truly matters: the happiness and health of your cherished companion. https://wagwalking.com/wag-wellness/pet-insurance

Wag! Compare is a free pet insurance comparison service and we help you compare the top insurance providers to get the best possible deal. https://www.reddit.com/r/personalfinance/comments/yzyyst/pet_insurance_comparison_tool/

10 votes, 10 comments. I'm shopping around for a pet insurance policy for our new cat. We were on Nationwide in the past and were happy with ... https://figopetinsurance.com/pet-insurance-comparison

Look closely at covered medical expenses, and more importantly, expenses not covered when you compare pet insurance companies. All pet healthcare coverage ...

|